Discovering the Lawful Elements of Bid Bonds in Construction Contracts

Wiki Article

Important Actions to Obtain and Use Bid Bonds Successfully

Navigating the intricacies of quote bonds can considerably impact your success in securing agreements. The genuine challenge exists in the careful option of a respectable supplier and the tactical utilization of the proposal bond to improve your competitive side.Comprehending Bid Bonds

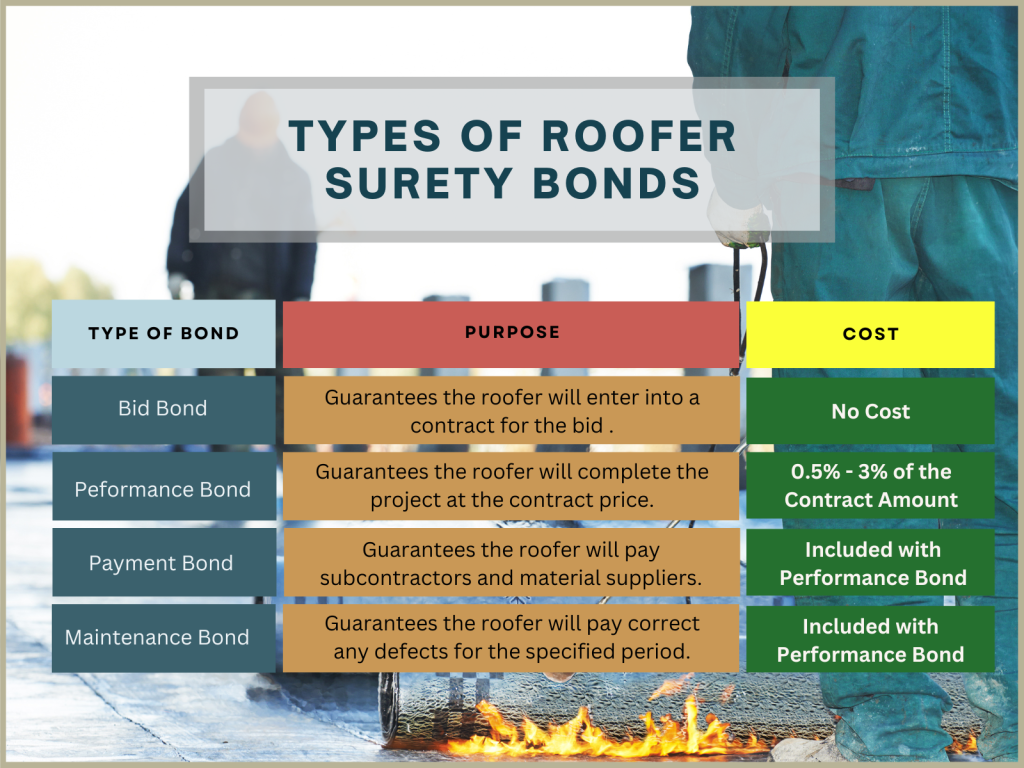

Proposal bonds are an important element in the construction and having market, serving as an economic assurance that a prospective buyer means to become part of the contract at the proposal cost if awarded. Bid Bonds. These bonds minimize the danger for task owners, ensuring that the picked specialist will not just honor the proposal however additionally safe performance and repayment bonds as requiredEssentially, a bid bond functions as a safeguard, shielding the job owner against the economic ramifications of a contractor failing or withdrawing a bid to begin the task after option. Typically issued by a surety company, the bond guarantees settlement to the owner, typically 5-20% of the proposal amount, need to the professional default.

In this context, proposal bonds foster a much more trustworthy and competitive bidding atmosphere. They urge professionals to present sensible and serious bids, understanding that a monetary fine impends over any kind of breach of commitment. These bonds make certain that just monetarily secure and qualified contractors get involved, as the strenuous credentials procedure by surety firms displays out much less trusted prospective buyers. Subsequently, quote bonds play a vital function in preserving the integrity and smooth operation of the building bidding procedure.

Planning For the Application

When preparing for the application of a quote bond, thorough organization and complete documentation are critical. A thorough review of the project specs and bid demands is necessary to ensure compliance with all stipulations.

Following, assemble a checklist of previous projects, particularly those similar in range and dimension, highlighting effective conclusions and any awards or accreditations obtained. This profile works as proof of your company's ability and dependability. Furthermore, prepare an in-depth organization strategy that details your functional approach, threat monitoring techniques, and any contingency prepares in location. This plan offers a holistic view of your company's approach to task implementation.

Make certain that your organization licenses and enrollments are updated and easily offered. Having actually these files arranged not just accelerates the application process yet also predicts a specialist picture, instilling self-confidence in prospective surety suppliers and project proprietors - Bid Bonds. By systematically preparing these elements, you place your company favorably for effective bid bond applications

Locating a Surety Service Provider

A guaranty company familiar with your area will certainly better comprehend the special threats and demands linked with your projects. It is also a good idea to assess their financial scores from firms like A.M. Ideal or Standard & Poor's, guaranteeing they have the economic toughness to back their bonds.

Involve with numerous companies to contrast rates, solutions, and terms. An affordable analysis will certainly help you secure the very best terms for your quote bond. Inevitably, a thorough vetting process will certainly guarantee a trustworthy collaboration, cultivating self-confidence in your proposals and future tasks.

Sending the Application

Sending the application for a proposal bond is a crucial step that calls for meticulous attention to detail. This process starts by collecting all pertinent documents, consisting of monetary statements, task specs, and a comprehensive business background. Ensuring the precision and completeness of these records is vital, as any discrepancies can bring about rejections or hold-ups.

When filling out the application, it is a good idea to ascertain all entries for accuracy. This includes verifying figures, making sure correct signatures, and confirming that all necessary attachments are consisted of. Any kind of mistakes or noninclusions can threaten your application, creating unneeded complications.

Leveraging Your Bid Bond

Leveraging your bid bond properly can substantially enhance your affordable edge in protecting agreements. A quote bond not just demonstrates your economic stability official site however also guarantees the project proprietor of your commitment to satisfying the agreement terms. By showcasing your bid bond, you can underscore your firm's dependability and reliability, making your quote stand out among countless competitors.To utilize your bid bond to its maximum potential, site here ensure it is offered as component of an extensive quote plan. Highlight the strength of your surety provider, as this reflects your business's economic health and functional ability. In addition, emphasizing your track record of efficiently finished projects can even more impart self-confidence in the project owner.

Furthermore, preserving close communication with your surety company can promote far better terms and conditions in future bonds, thus reinforcing your competitive positioning. A positive technique to handling and restoring your quote bonds can likewise protect against lapses and guarantee continuous coverage, which is vital for continuous job procurement initiatives.

Verdict

Properly getting and making use of bid bonds necessitates thorough prep work and critical execution. By comprehensively organizing vital documents, choosing a credible surety company, and submitting a full application, companies can protect the necessary proposal bonds to improve their competitiveness. Leveraging these bonds in propositions highlights the firm's dependability and the strength of the guaranty, eventually increasing the chance of protecting contracts. Continual communication with the guaranty supplier guarantees future opportunities for effective project quotes.

Determining a trusted surety provider is a crucial step in safeguarding a bid bond. A bid bond not just demonstrates your monetary stability however additionally guarantees the task owner of your commitment to satisfying the agreement terms. Bid Bonds. By showcasing your bid bond, you can underline your firm's dependability page and reliability, making your quote stand out amongst countless rivals

To leverage your quote bond to its maximum potential, guarantee it is presented as component of a thorough bid package. By comprehensively organizing crucial documents, picking a respectable guaranty carrier, and submitting a complete application, companies can safeguard the necessary bid bonds to enhance their competitiveness.

Report this wiki page